Navigate the World of Standard Essential Patents and Standards’ Contributions

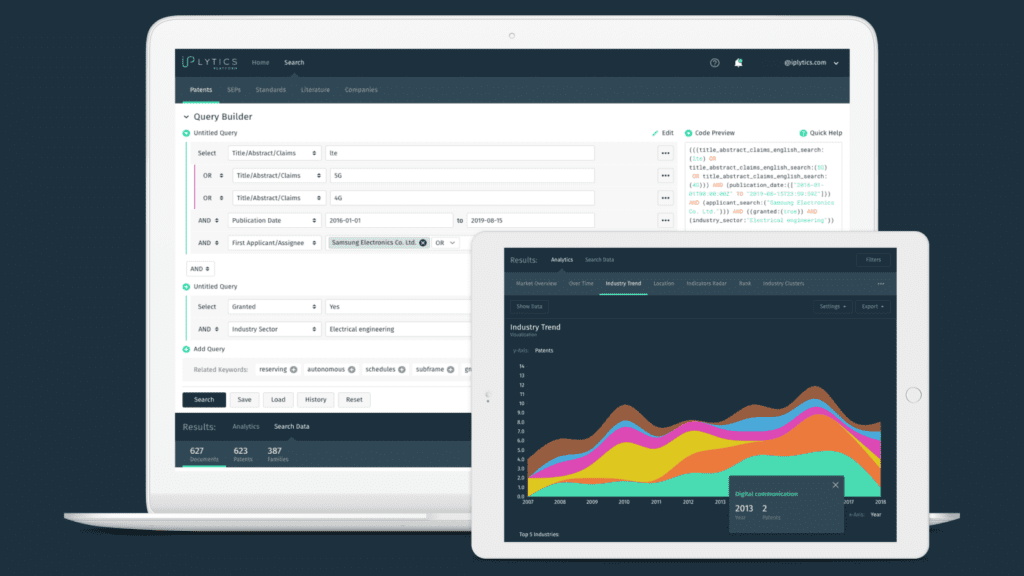

Leverage transparent and accessible data for SEPs, Technical standards, and contribution data analysis to ensure the success of your patent portfolio with LexisNexis® IPlytics.

Turn patents and standards data into action and make profound business decisions

As a patent professional, you can enhance the performance of your patent portfolio by utilizing IPlytics’ reliable and user-friendly data on SEPs, technical standards, and contribution data analysis. Access transparent and easily understandable insights, empowering you to make informed decisions and achieve success.

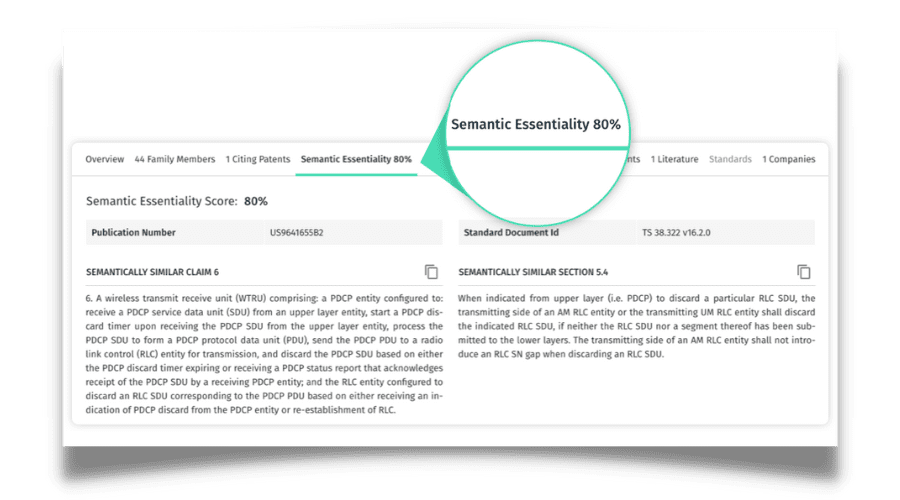

Semantic Essentiality Score

Your first step to determining patent essentiality

The IPlytics Semantic Essentiality Score guides you on how likely essential a patent is to the standard it is declared for. Using a semantic mapping of independent patent claims to standard sections, an essentiality score is calculated ranging from 1-100 with 100 being the most likely essential.

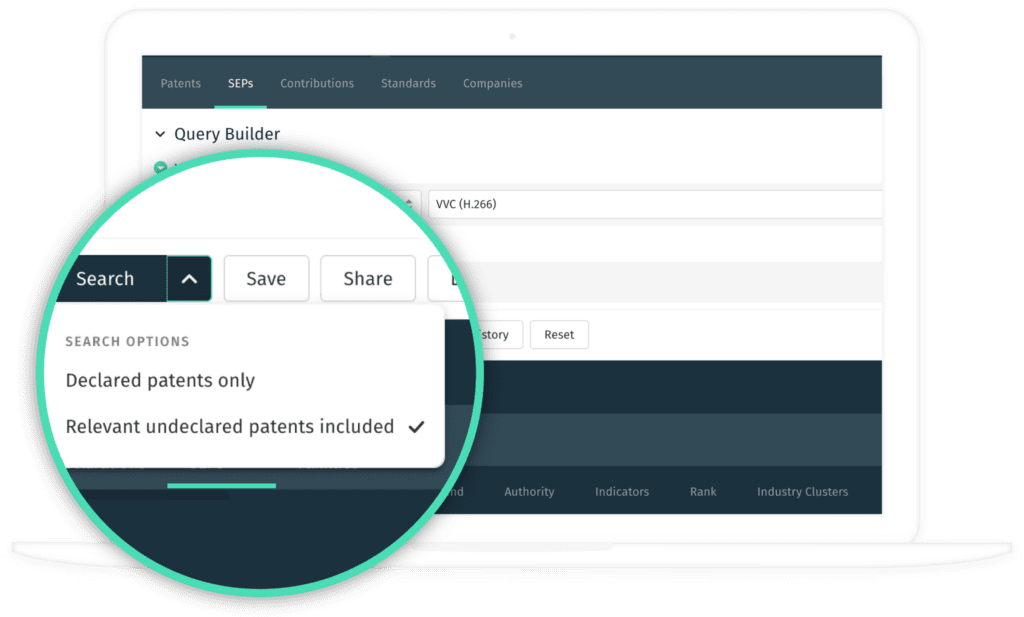

Undeclared Patent Universe

Identify the Wi-Fi, Video Coding and Qi patent landscape all in one place

LexisNexis® IPlytics has expanded its database solutions to include undeclared patents potentially essential to AVC, HEVC, and VVC video coding generations, Wi-Fi 4, Wi-Fi 5, Wi-Fi 6 generations, and Qi 1 (wireless charging) generation.

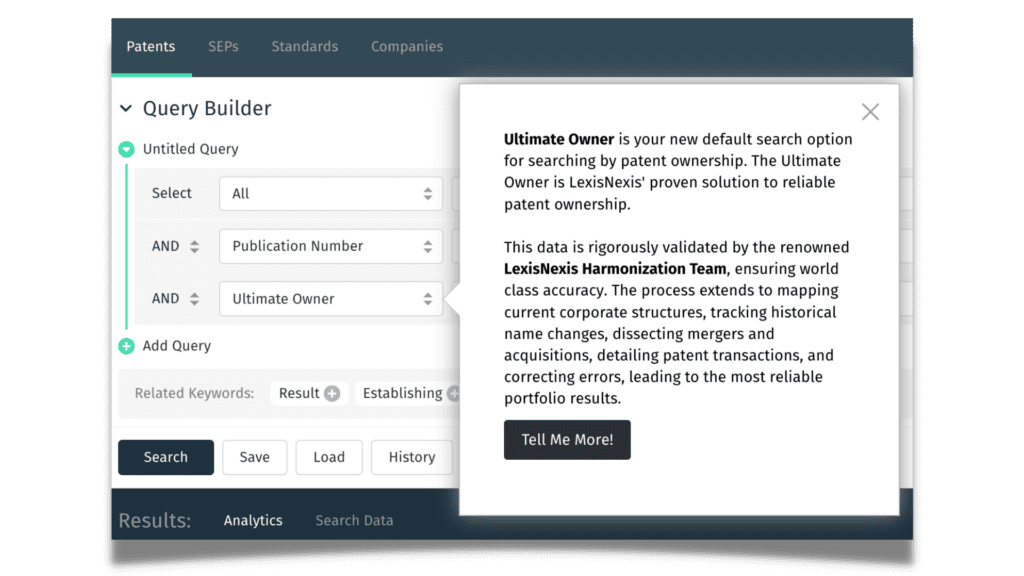

Ultimate Owner

Get a holistic view of patent ownership within the realm of SEPs

Ultimate Owner is a game-changing addition to IPlytics that promises to revolutionize the way you navigate the SEP landscape. At its core, the Ultimate Owner concept recognizes that parent companies often exert control over patents held by subsidiaries, joint ventures, and affiliates. This concept equips you with the tools to make informed licensing, negotiations, and portfolio management decisions.

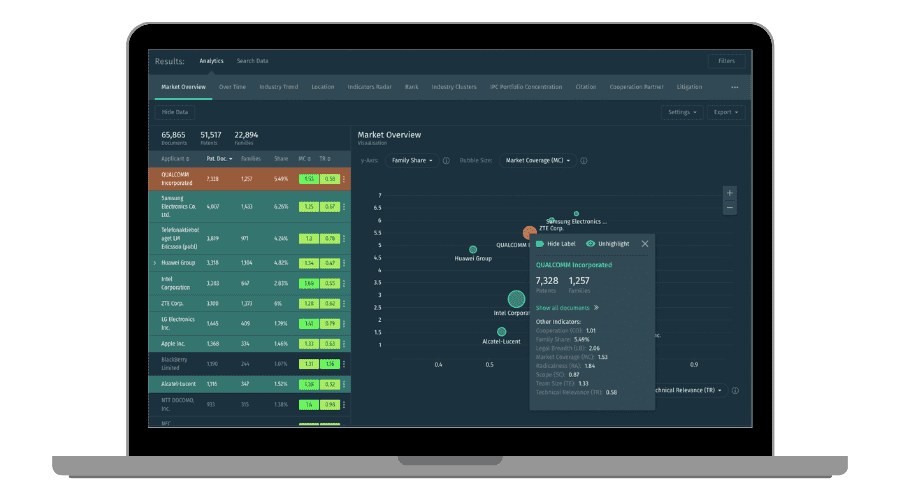

Overcome complexity in data-led decisions

Standard Essential Patents

Access to ownership information of patents declared to worldwide standards

Standards Contribution

Explore companies’ technology investments in standards

Litigation Cases

Gain insights on market disputes on patented technology through litigation cases

Patent Pools

Be informed about the accessibility of SEP-protected technology

Semantic Essentiality

Determine standard essentiality of declared patents

Want to explore the IPlytics Platform? Get in touch

The Patent Intelligence Platform to make FRAND License Negotiation in your favor and determine essentiality likelihood before you make decisions.

How top professionals use IPlytics

SEP licensors

- Align your standards development, patent prosecution, patent portfolio management, and licensing/monetarization strategy to file valid and essential patents and to commercialize SEPs in worldwide licensing campaigns.

- Value and benchmark your SEP portfolio for cross-license negotiations and monitor competition.

- Examine competitors’ standards development investments and identify new standards initiatives to maintain leading positions in standards development.

Patent portfolio managers

- Identify the strengths and weaknesses of your SEP portfolios and benchmark it against your competitors.

- Measure and track your market share for standards such as 4G, 5G, Wi-Fi, video codec (HEVC/VVC), and many more.

- Support keeps/kills decisions to further develop your SEP portfolio.

Licensing executives & Dealmakers

- Value your SEP portfolio to weed out ‘weaker’ patents, focusing resources on higher-ranked patents.

- Find gold nuggets in your portfolio to identify patents to license or sell.

- Monitor the market and track ownership changes and litigation trends.

SEP licensees

- Value and determine SEP portfolios offered for license. Prepare for FRAND negotiation and identify the numerator and denominator to measure patent holders’ market share.

- Identify standards subject to SEPs in the complex product value chain of suppliers.

- Monitor SEP filing, SEP change of ownership, and litigation to quantify risks and plan royalty payments.

- Identify industry-related (e.g. V2X, NB-IoT, M2M) standards initiatives to have a seat at the table when future connectivity technology is developed.

Licensing managers & Legal divisions

- Identify the market share of patents offered for licensing-in technologies.

- Get access to objective data to consider for FRAND preparation, negotiations, and argument formulation.

- Understand if the offered SEP portfolio is “essential”.

Strategic IP attorneys

- Identify SEPs that are relevant to your products.

- Identify leading patent owners and share of patents licensed in patent pools.

- Understand the risk to be litigated in your market.

Learn More about the world of SEPs

Who is Leading the 5G Patent Race?

In this on-demand webinar our experts have a wide-ranging conversation about who is leading the 5G patent race.

The All-New Semantic Essentiality Score is Here! A Redefined Approach to Determining Patent Essentiality

The Semantic Essentiality Score (SES) is your guide to determining essentiality for individual patents or entire portfolios.

SEP Litigation Trends: What Does the Data Say?

This report is an analysis of recent SEP litigation trends including who drives the litigation and which are the most litigated standards.

Empowering SEP Analysts With Insights: Unveiling the Ultimate Owner Concept in LexisNexis IPlytics

LexisNexis® IPlytics has unveiled the Ultimate Owner Concept which will empower SEP analysts and stakeholders with essential insights.

The SEP Couch Podcast

Get the latest on current topics related to standard essential patents (SEPs), including FRAND, licensing, litigation, dealmaking, policy, regulation, and general market trends where SEPs are important.

The Art of SEP Claim Drafting – Episode 24

SEP claim drafting is more complex as the language used in an invention disclosure may be different than that used in a standards document.

IP Europe’s Take on FRAND – Episode 23

In this podcast Patrick McCutcheon, the Managing Director of IP Europe, discusses IP Europe’s take on FRAND.

SEPs and the Law in Brazil – Episode 22

In this podcast Otto Licks and Roberto Rodrigues discuss their experiences with SEPs and the law in Brazil.

SEP Portfolio Management – Episode 21

The patent portfolio life cycle management approached demonstrates that SEP portfolio management is not about the life cycle of one patent.